capital gains tax indonesia

Conversely a capital loss occurs when you sell an asset for less than what you paid. It also specifies the method.

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

The tax is 5 final tax or 25 from 8 September 2016 on the taxable sale value or the actual.

. Indonesia Highlights 2022 Page 2 of 10 Corporate taxation Rates Corporate income tax rate 22 Branch tax rate 22 plus 20 branch profits tax in certain circumstances Capital gains tax rate 22 standard ratevarious Residence. Sale of land andor buildings located in Indonesia. The tax traps wealth in an investment vehicle requiring special techniques to free the capital without penalty.

The capital gains tax is economically senseless. Of capital gains business profits personal service income and other income. Capital gains tax also known as CGT is a type of tax paid when you sell an asset for more than you bought it for.

This publication is the tenth edition of the full version of the OECD Model Tax Convention on Income and on Capital. It is the 1 selling tax preparation. You have to add the US.

Nonresidents of California generally are not taxed by California on gain resulting from the sale of partnership interests. Individual Income Tax Return. Unfortunately since no US.

4 The provisions of paragraph 3 shall not affect. Capital Gains Account Scheme. For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0.

Multiple ways are available to. What is capital gains tax. Find out information on the UKs tax treaties related taxation documents and multilateral agreements.

TurboTax has been serving Canadians since 1993. In most of the cases the available time limit is longer and sometimes. 2439 Notice to Shareholder of Undistributed Long-Term Capital Gains.

To encourage the reinvestment of the capital gains that are made on the sale of the capital assets through the seller the Indian government has given the relief from the tax of the capital gains if such capital gains are reinvested in some specific assets in a mentioned time limit. 3115 Application for Change in Accounting Method. A capital gain or loss is the difference between what you paid for an asset and what you sold it for less any fees incurred during the purchaseSo if you sell a property for more than you paid for it thats a capital gain.

The country offers several tax breaks boasts a relatively low corporate tax rate and top personal tax bracket and it does not levy taxes. Indonesian taxation is based on Article 23A of UUD 1945 1945 Indonesian Constitution where tax is an enforceable contribution exposed on all Indonesian citizens foreign nationals and residents who have resided for 183 cumulative days within a twelve-month period or are present for at least one day with intent to remainGenerally if one is present less than. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the.

A company is regarded as Indonesian tax resident if it is established or domiciled in Indonesia or if its place of. Taxes were withheld there is not a tax credit to apply against the income. A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory asset.

Capital gains are generally assessable at standard income rates. Above rates are to be enhanced by surcharge and health and education cess. Under new guidance issued by the California Franchise Tax Board FTB nonresidents can now expect to be subject to California tax on a portion of such gain with respect to any partnership that has been filing a tax return with California.

Income to your Canadian tax return and pay Canadian tax on it. 6251 Alternative Minimum Tax. You have to pay the higher Canadian tax rate on the income in full.

Schedule D Form 1040 Capital Gains and Losses. And benefit of tax treaty for non-residents. Income Tax Return for Seniors.

Tax include a former citizen whose loss of citizenship had as one of its principal purposes the avoidance of tax but only for a period of 10 years following such loss. Capital gains tax CGT for those who are new to this is the levy you pay on the capital gain made from the sale of that asset. The 1012 Tax Bracket.

This full version contains the full text of the Model Tax Convention as it read on 21 November 2017 including the Articles Commentaries non-member economies positions the Recommendation of the OECD Council the historical notes and the. Indonesia Last reviewed 22. 1099 General Instructions for Certain Information Returns.

Headline corporate capital gains tax rate Headline individual capital gains tax rate Albania Last reviewed 21 June 2022 15.

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Indonesia Payroll And Tax Guide

The Reason For The Globalisation Of Tech R D The Continental Telegraph Global Japan Economics

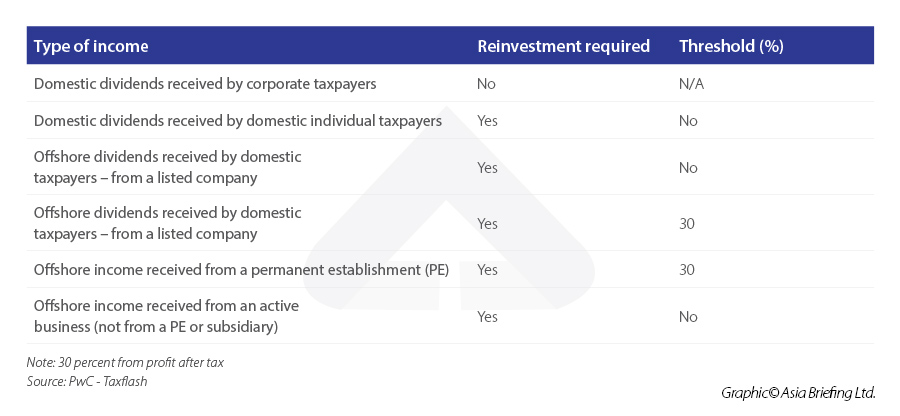

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

One Of Classic Car Shown At An Exhibition By Indonesian S Iccoc Grand Indonesia Jakarta A Newly Opened Sho Classic Cars Classic Car Insurance Car Insurance

Indonesia Payroll And Tax Guide

Corporate Income Tax In Indonesia Acclime Indonesia

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

Instagram Post By Lavonya Jones Nov 20 2017 At 7 43pm Utc

Indonesia To Impose Vat Income Tax On Crypto Assets From May Reuters

Corporate Income Tax Rate And Facility Income Tax Capital Gains Tax Filing Taxes

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

With Its Breathtaking Backdrop Of The Dreamland Pecatu Bali Indonesia This 16 Units Villa And 87 Units Apartments Is In The Perfect Setting For A Special Fam